Depreciation schedule for rental property calculator

Depreciation commences as soon as the property is placed in service or available to use as a rental. I inherited a rental property that was being depreciated.

Investment Property Calculator Home Facebook

Property depreciation for real estate related to MACRS.

. You have purchased a residential property in a good neighbourhood as an investment so depreciation is the last thing you probably consider. Vyapar depreciation calculator can help you create a depreciation schedule for any fixed asset. Use a Tax Depreciation Calculator.

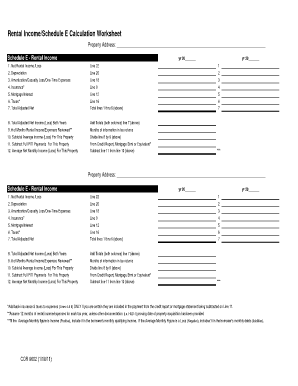

Allocate that cost to the different types of property included in your rental such as land buildings so on. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. Calculate Property Depreciation With Property Depreciation Calculator.

Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. Investors should use a rental property calculator to analyze potential deals or evaluating existing rental properties.

Heres an example of a rental property purchased with cash. Depreciation Recapture for Rental Properties. PropCalc the essential cash flow calculator for anyone looking to buy a property.

An asset depreciation schedule represents how the value of an asset depreciates over the years using a table. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. Residential rental property is depreciated at a rate of 3636 each.

A tax depreciation schedule from BMT helps all residential investment property owners claim maximum property tax depreciation deductions. This means that any gain you earn from selling your property will incur both capital gains taxes and other taxes. Rental Property Calculator - This rental property calculator lets you enter all your financial projections.

List your total income expenses and depreciation for each rental. By convention most US. To figure out the depreciation on your rental property.

Reviewed for accuracy by Janet Berry-Johnson CPA. 39 years for commercial buildings. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400.

They were being depreciated with a. There are several depreciation calculators on the market many of which can be found easily through a Google search for depreciation calculator. In that case you should use an investment property depreciation calculator to get at least a general idea about the tax deductions you can claim in your tax return.

Determine your cost or other tax basis for the property. Companies create depreciation expense schedule using any depreciation method suited for their business. The calculation is based on the Modified Accelerated Cost Recovery method as described in Chapter 4 of IRS Publication 946 - How To Depreciate Property.

But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation. Many expenses can be deducted in the year you spend the money but depreciation is different. Claiming catch-up depreciation is a change in the accounting method.

What is Property Depreciation Schedule and How Can Tax Depreciation and Depreciation on Your Investment Property Increase Cash Flow. Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods. You claimed more or less than the allowable depreciation on a depreciable asset.

When you rent property to others you must report the rent as income on your taxes. In my opinion the best ones are free. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Calculating MACRS depreciation is more complicated than other methods outlined above. Therefore according to the Australian tax law you can claim tax deductions on. Whether you choose an online rental calculator or pen and paper be careful to determine the above variables to ensure your deal analysis is as accurate as possible.

Dont pay for a property depreciation estimate. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years.

You didnt claim depreciation in prior years on a depreciable asset. Each property is different and many factors must be considered when preparing a property depreciation schedule. The closing costs were 1000 and remodeling costs totaled 9000 bringing your.

Part 2 discusses how to calculate the MACRS depreciation Rate using Excel formulas. Section 179 deduction dollar limits. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning.

It will calculate straight line or declining method depreciation. Suppose you need to calculate the depreciation of your property. This innovative calculator allows users to customise their income property expenses and cash flow to get a realistic.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. What is an asset depreciation schedule.

It and its new floor coverings and appliances have been depreciated for 2 tax years. This calculator will calculate the rate and expense amount for personal or real property for a given year. Plus the calculator also gives you the option to include a year-by-year depreciation schedule in the.

When To Use A Rental Property Calculator. Rules Macrs depreciation schedule Recapture How Residential Rental Property Depreciation Works What Properties Are Depreciable Rental Property Depreciation Method Rental Property Depreciation Schedule Reporting Depreciation of Rental Property Rental. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

Part 3 provides a Depreciation Calculator that can be used to. Catch-up depreciation is an adjustment to correct improper depreciation. This page is the first of a 3-part series covering Depreciation in Excel.

You can use the tables included in IRS Publication 946 use a MACRS Depreciation Calculator or get help from your tax advisor. Contact us today to see how we can help. But what about the other assets.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Then it automatically. One of the biggest differences between depreciation recapture for equipment and rental properties is that the final recapture value for properties takes capital gains tax into account.

You paid 100000 in cash for the rental property. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. After all the objective is for the property to increase in value.

275 years for residential rental properties. From the source of fitsmallbusiness Rental Property Depreciation. Since 2001 Depreciator have been producing ATO compliant Tax Depreciation Schedules for thousands of property investors nationwide.

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Irs Publication 946

Rental Property Calculator Spreadsheet Youtube

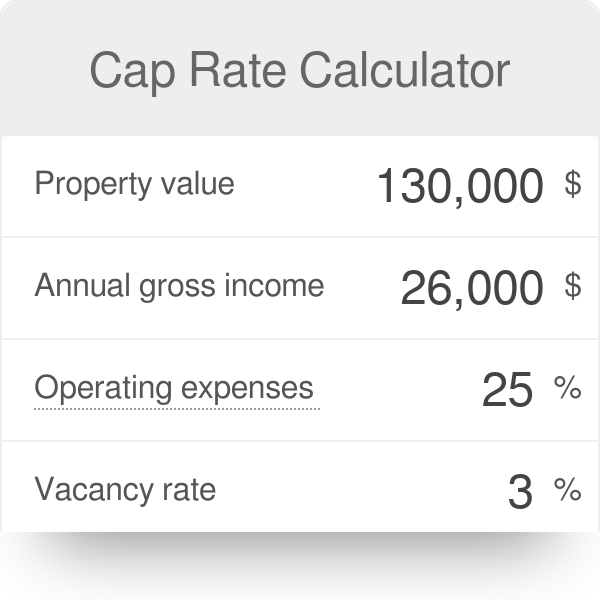

Cap Rate Calculator

Rental Property Calculator Most Accurate Forecast

What Is Rental Property Depreciation And How Does It Work

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Calculator Most Accurate Forecast

How To Calculate Depreciation On Rental Property

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Depreciation On A Rental Property

Pin On Airbnb

Rental Property Cash Flow Calculator

Residential Rental Property Depreciation Calculation Depreciation Guru

Investing Rental Property Calculator Roi Mls Mortgage

Investment Property Analyzer Rental Property Calculator Etsy